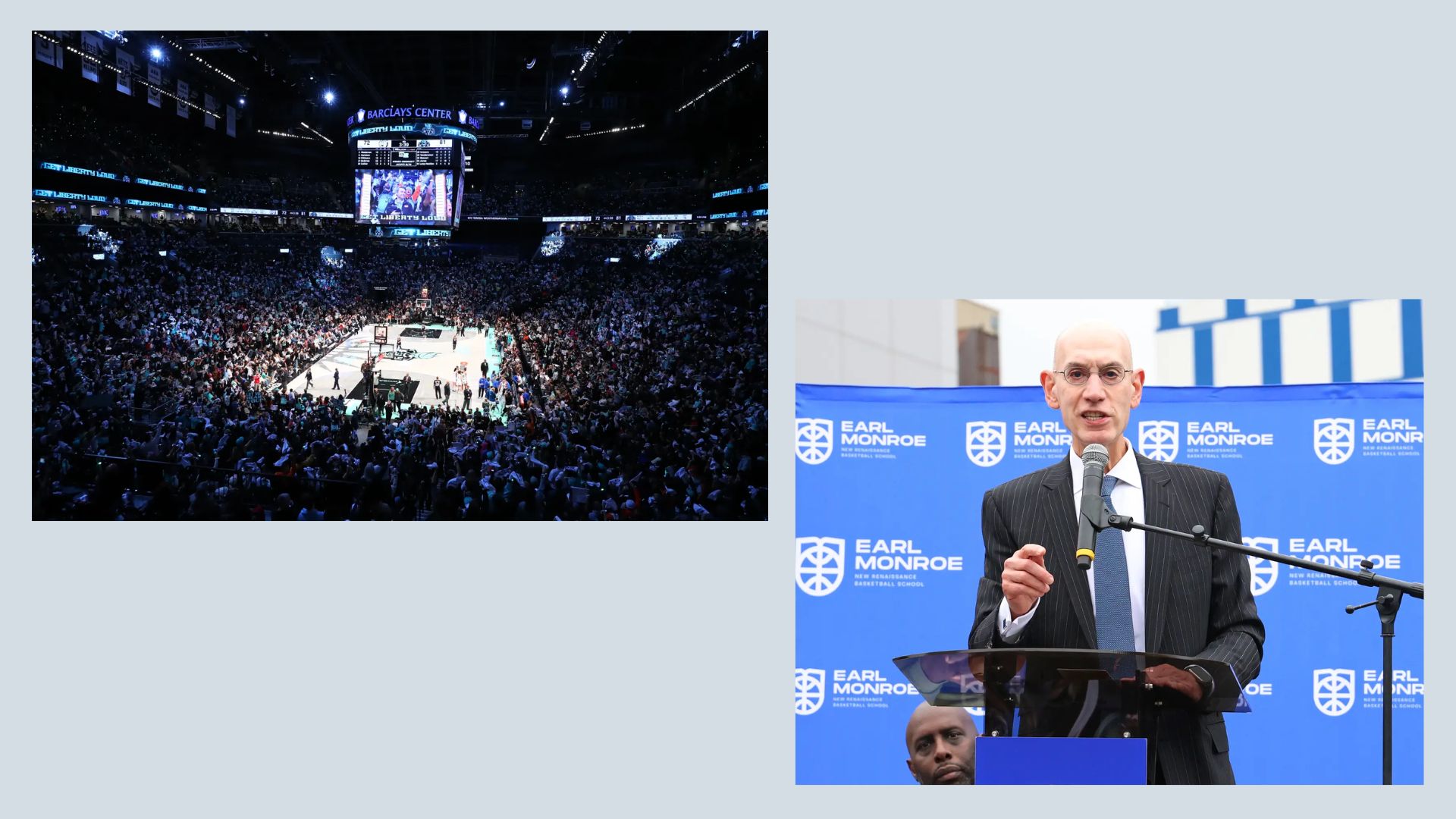

The WNBA is witnessing packed arenas and increased viewership, particularly during the finals matchup between the New York Liberty and Minnesota Lynx. However, behind the scenes, financial struggles continue to plague the league. Despite the recent surge in popularity, the WNBA is projected to lose $40 million this season. Although slightly improved from earlier forecasts of a $50 million deficit, the league’s ongoing losses are concerning to its investors, most notably the NBA.

NBA’s Significant Stake in the WNBA

The NBA owns nearly 60% of the WNBA, and when accounting for NBA team owners’ personal stakes in individual WNBA teams, the combined ownership reaches approximately 75%. This heavy investment has accumulated over hundreds of millions of dollars since the league’s inception in 1996. Yet, for NBA owners who have poured in substantial funds over the years, the WNBA has yet to yield a profitable return.

An NBA executive pointed out the bleak outlook for the league’s profitability, stating, “The WNBA owes the NBA so much we won’t see any windfall for years.” The concerns are amplified as the league continues to struggle financially despite recent growth in audience engagement.

New Media Deals Offer Hope for 2026 and Beyond

There is some optimism on the horizon. Starting in the 2026 season, the WNBA is set to receive up to $2.2 billion over 11 years through new media contracts. This deal is projected to boost annual media revenue by at least $100 million, significantly higher than the current $60 million earned from national media rights.

To capitalize on this opportunity, the WNBA is planning to expand its regular-season and playoff schedule, which could help increase revenue streams. However, potential gains could be offset by rising expenses. The players are expected to opt out of the current collective bargaining agreement by the November 1 deadline. If this occurs, higher salaries will likely be a focal point of the new contract, which may reduce the anticipated $60 million profit in 2026. What was once a projected $40 million loss could indeed turn into a $60 million gain, but challenges remain.

Expansion Fees: A Missed Opportunity for NBA Owners

One contentious issue among NBA investors is the handling of expansion fees. Recent expansion efforts have brought new money into the WNBA, such as Golden State Warriors owner Joe Lacob paying a $50 million fee to launch a team, and Toronto Raptors minority owner Larry Tanenbaum paying $115 million for a new team and practice center. However, none of these expansion fees have gone to the NBA owners.

“There is frustration over not seeing any money from WNBA expansion fees,” an NBA team executive commented. While NBA team owners benefit from NBA expansion fees, the same approach has not been applied to the WNBA, raising questions about financial transparency.

Pressure Mounts on Commissioner Adam Silver

Some NBA owners have begun to push for more accountability and clarity regarding the WNBA’s financial future. New York Knicks owner James Dolan, in particular, has reportedly been pressuring NBA Commissioner Adam Silver for answers on when the league’s investors can expect a return.

“There’s a group of owners who see Dolan as a hero for pushing Silver on these questions,” noted an insider. However, sources claim that Silver has yet to provide any concrete answers, leaving many investors frustrated.

An NBA spokesperson addressed the concerns by stating that financial reports, including detailed revenue and expenses, are shared with both the NBA and WNBA Boards of Governors. Nonetheless, some owners feel these reports are consolidated with NBA financials, making it difficult to isolate the WNBA’s specific financial performance.

Looking Forward: Can the WNBA Turn Its Fortunes Around?

Despite the league’s financial struggles, there is no denying the excitement surrounding the WNBA’s current season. The New York Liberty’s recent Game One finals matchup saw a sold-out Barclays Center, while star players like Sabrina Ionescu continue to captivate audiences. Yet, turning this enthusiasm into profitability remains a significant challenge.

Upcoming changes, including expanded schedules and lucrative media deals, provide potential pathways for the WNBA to overcome its financial woes. However, achieving sustainable profitability will likely require more than just increased revenue. Strategic management, transparency, and careful control of expenses will be essential if the league hopes to break free from its current pattern of losses.

For now, the WNBA is caught in a delicate balancing act, striving to grow the sport while managing its mounting financial pressures. As NBA investors grow increasingly impatient, the future of the league rests on its ability to transform popularity into profit.